Debt, Be Gone

Two Smart Strategies to Finally Pay It Off

Let’s talk about the elephant in your wallet—debt.

Maybe it’s from student loans, car payments, credit cards, or that impulsive decision to redo the playroom with Montessori furniture.

The good news? Not all debt is bad. But unmanaged debt? High interest debt? That will hold you back from building wealth.

Once you’ve saved up 3–6 months of expenses in your emergency fund, it’s time to tackle your high-interest debt head-on. Luckily, there are two proven ways to do it:

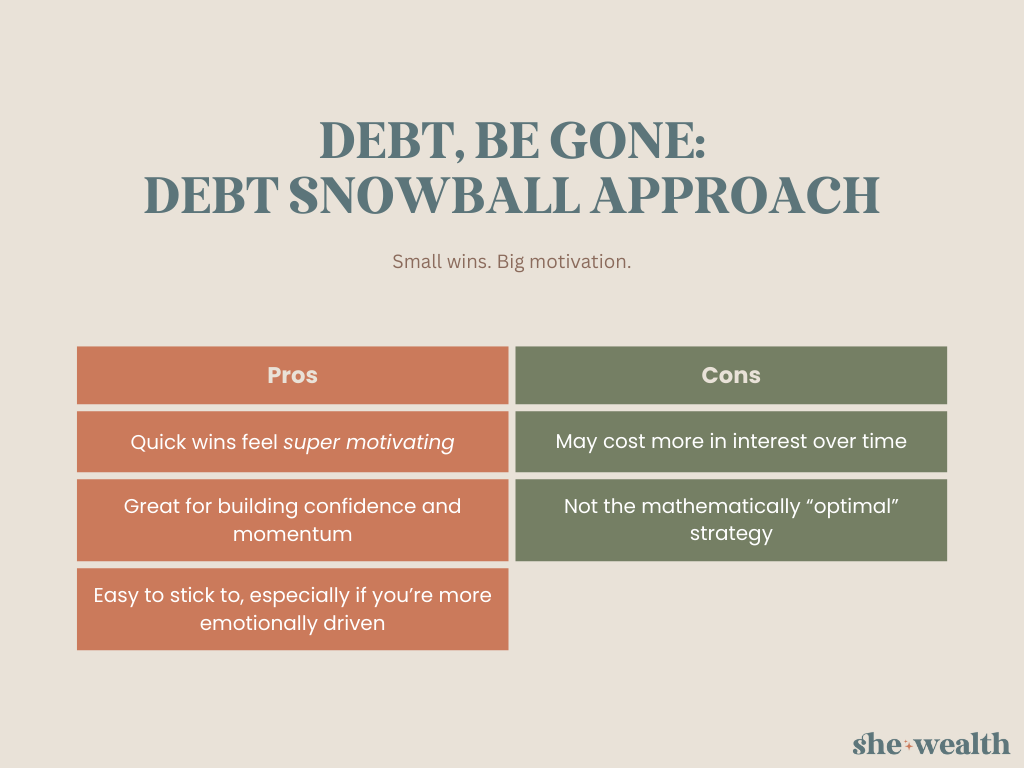

Debt Snowball: Small Wins, Big Motivation

With the debt snowball method, you pay off debts starting with the smallest balance first, regardless of interest rate.

Once you knock out the smallest debt, you roll that extra cash into the knocking out next smallest debt—like a snowball picking up speed, and size, as it rolls downhill.

For example:

$500 Target card at 17% interest

$2,000 credit card at 22% interest

$5,000 car loan at 6% interest

With the debt snowball approach, you would start by paying off the $500 Target card debt, knock it out, and celebrate your win. Then, you’d move onto the $2,000 credit card debt.

Debt Avalanche: Interest First, Savings Long-Term

With the debt avalanche method, you pay off debts starting with the highest interest rate first, regardless of balance.

This strategy saves you the most money in the long run, because it cuts down on the amount of interest you’re paying overall.

For example (same debts):

$2,000 credit card at 22% interest

$500 Target card at 17% interest

$5,000 car loan at 6% interest

You’d start with the $2,000 credit card, since it’s racking up the most interest. It may take a little longer to get that first win, but you’ll save more money overall.

Smart Mom Tip

Go with the strategy you’ll actually stick with.

Snowball is great if you need motivation and visible progress. Avalanche is ideal if you're laser-focused on saving the most.

Either way? You’re moving forward—and that’s what matters.

Mom Brain Recap

Debt Avalanche = Pay off the highest-interest debt first. Saves the most money.

Debt Snowball = Pay off the smallest balances first. Creates momentum and feels good fast.

Both strategies work—as long as you’re consistent.

Pick the one that fits your personality, energy, and money mindset.

At the end of the day, the best debt payoff plan is the one that gets done between soccer drop-off, PTO meetings, and reheating your coffee for the fourth time.

Ready to take charge of your debt? The free SheWealth Debt Repayment Worksheet in the Resource Garden is here to help you map it out.