Too Many Payments, Not Enough Peace

Consider Debt Consolidation

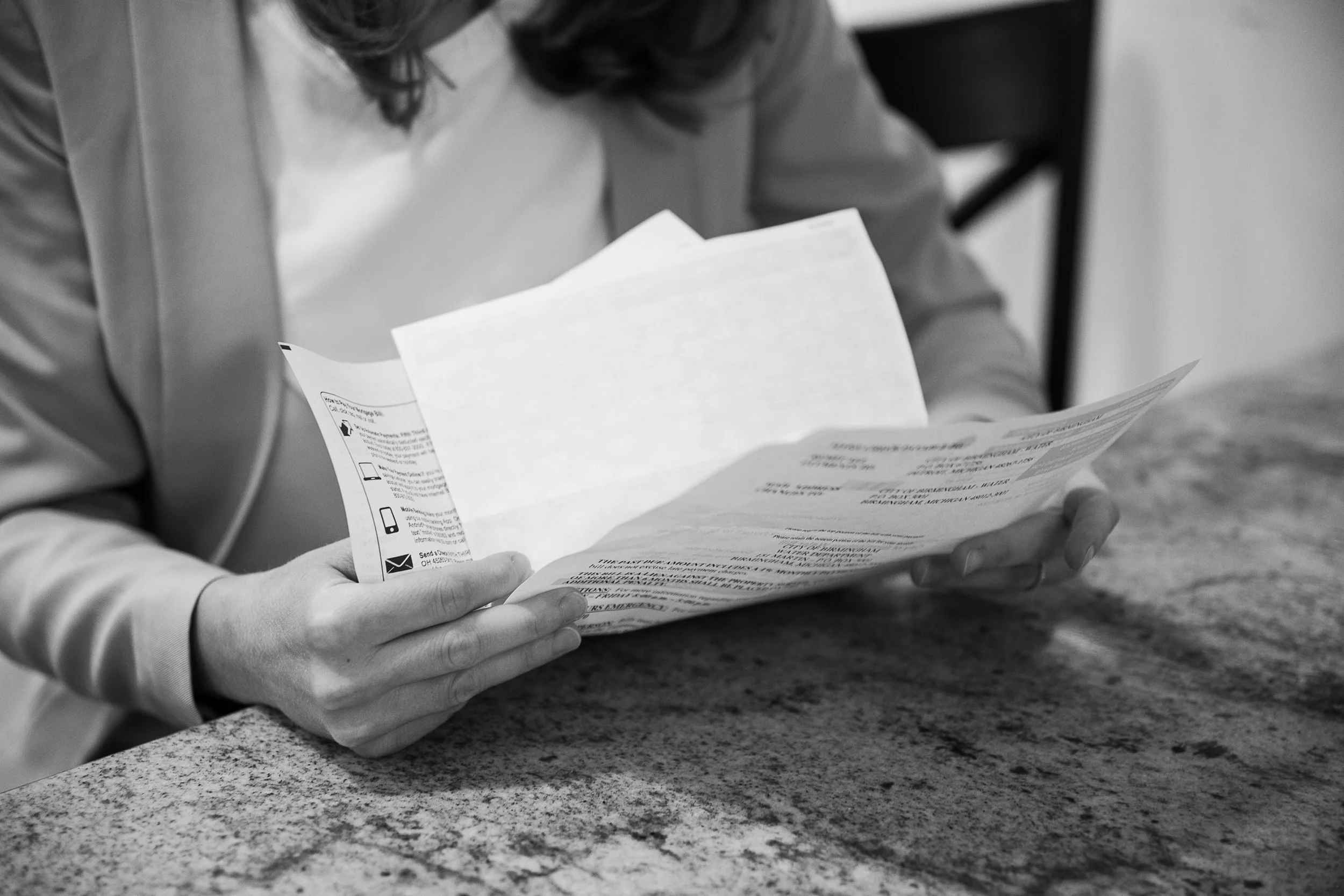

Do you have high-interest debt spread out across a bunch of credit cards, loans, or surprise medical bills? Do you feel like every time you open your mailbox you’re dodging another due date? Are you constantly asking, “Wait… did I already pay that one?”

If your brain is maxed out tracking minimum payments, interest rates, and what’s due when, it may be time to consider debt consolidation.

What Is Debt Consolidation?

In mom terms, it’s like organizing your financial junk drawer. Instead of having 10 different bills all due at different times, with different interest rates and stress levels, debt consolidation rolls them into one single loan, with one monthly payment and, ideally, a lower interest rate.

Sounds dreamy, right?

Here’s how it typically works:

You take out a personal loan (or balance transfer offer) to pay off your existing debts

You’re then left with just one loan to repay, usually at a fixed interest rate, over a set time period

Bonus: You get your mental bandwidth back

Why Debt Consolidation Can Be a Smart Move

Debt consolidation sometimes gets a bad rap, but in the right situation, it can be a powerful tool.

Benefits of Debt Consolidation:

Simplifies your payments into one monthly bill

Reduces your interest rate (if you qualify)

Can improve your credit score over time if you make on-time payments

Gives you a debt-free deadline—because the loan has a fixed term

Reduces the mental load of juggling 47 different due dates

But… It’s Not for Everyone

Debt consolidation isn’t a magic fix, it’s a financial tool. And like any tool, it works best when used the right way.

Things to watch out for:

You’ll need good to decent credit to qualify for a low-interest consolidation loan

If you keep using your credit cards after consolidating, you could end up doubling your debt

Some loans come with fees—check the fine print

You have to stay disciplined—no going back to old spending habits

Smart Mom Tip

If you go the consolidation route:

Don’t close your old accounts right away—this can ding your credit score. Just stop using them

Set up autopay on your new loan so you never miss a payment

Use this as a reset, not a free pass. Focus on building new habits, creating a budget, and (eventually) investing for your future

Mom Brain Recap

Debt consolidation = combining multiple debts into one single loan with one monthly payment

Best for moms who are overwhelmed by high-interest debts and multiple payments

Look for a low, fixed-interest, no-fee loan and commit to not adding more debt

A smart, structured strategy to pay off debt faster, more affordably, and with way less stress

Life’s hard enough without tracking six due dates and three login passwords. Debt consolidation might just be the fresh financial start you need to simplify your debt and reclaim your financial peace.

Need a clear picture of what you owe? Use the free SheWealth Debt Repayment Worksheet to lay out all your debts, compare interest rates, and decide if debt consolidation is worth exploring. You’ll find it in the Resource Garden.